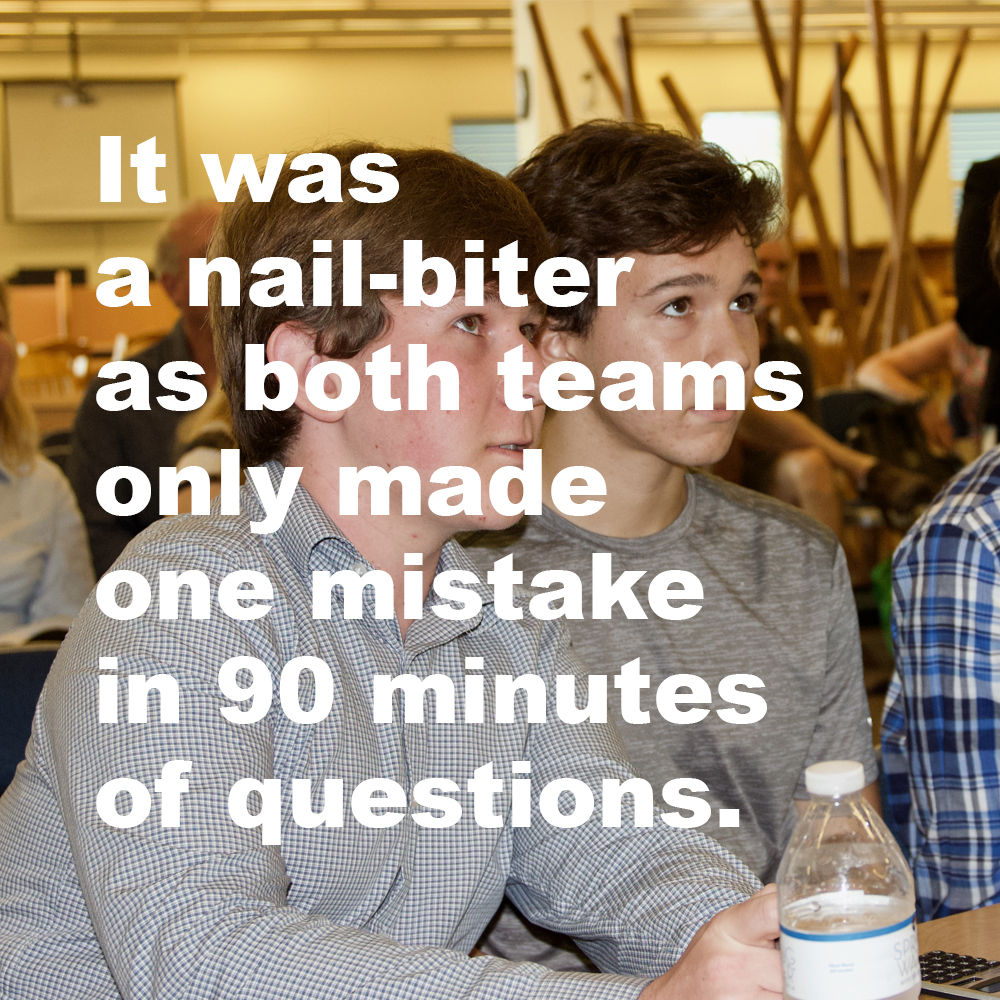

It was a photo finish at the “Financial Fitness Challenge” on April 9. Six high school students, in two teams, answered dozens of questions testing their financial literacy: What is laissez-faire economics? What does net income mean? Is interest on a savings account taxable? The kids studied material provided by National Endowment for Financial Education and VISA’s Practical Money Skills; at stake was $15,000 for the winning team, $5000 for each student. And it was a nail-biter as both teams only made one mistake in 90 minutes of questions.

“I have never seen anything like this,” said Juli Lewis, of Southeastern Credit Union Foundation. “There was a team from Alabama in this twice and never got as many right as you kids.” The credit union created the challenge for students of Alabama and Florida three years ago; this is the first year Key West students have participated, thanks to the Chamber of Commerce and The Keys Federal Credit Union. Twenty-two chamber members offered to supply the $250 sponsorships for each team, although there were only 11 teams in the end. And The Keys Federal Credit Union generously donated the $15,000 prize money.

Team One consisted of John Mott, Christian Brannon and Alan Demier. What motivated them to take the challenge? “On a personal level, I want to be an entrepreneur,” said Brannon, while Demier talked about being a venture capitalist. And if he won the money? Brannon didn’t miss a beat, “I would start a business.”

Their challengers, Team Two members, Taylor Olive, Rachel Wilcox and Iain Wilcox, seemed confident aside from the nervous toe tapping under the table. They were obviously prepared. If they won, Olive said, “I would put it in a low risk Treasury bond or CD.”

The game initially consisted of three rounds of five questions, best two out of three with a sudden death round if tied. Right from the start, correct answer after correct answer, it was going to be a showdown. Team Two lost round one in sudden death by one answer. Round two resulted in sudden death with a total of 30 rounds of questions and the computer eventually gave up and stalled, resulting in a tie. Round three, sudden death again and eventually the computer began repeating the questions they had already answered, but Team One lost by one question.

The game initially consisted of three rounds of five questions, best two out of three with a sudden death round if tied. Right from the start, correct answer after correct answer, it was going to be a showdown. Team Two lost round one in sudden death by one answer. Round two resulted in sudden death with a total of 30 rounds of questions and the computer eventually gave up and stalled, resulting in a tie. Round three, sudden death again and eventually the computer began repeating the questions they had already answered, but Team One lost by one question.

“This cannot get any more suspenseful,” said Lewis, impressed by Key West’s ability. Each team headed to an online version of the game, resulting in a final score equally close, but with a clear winner. So who knew what HELOC stands for, or can calculate credit-worthiness best? Team Two came out ahead by just a few points, but a heartfelt congratulations to both teams, who came out ahead when it comes to a good financial education. Team Two will head to another online competition against other Florida teams to go to the final championship in Orlando with an all-expense paid trip and more prize money.

- • • • •

32 percent of High school seniors are using credit cards.

26 percent of parents feel prepared to educate kids on finances.

44 percent of money issues at home affect performance at school.

More than 80 percent of students would like more financial education.