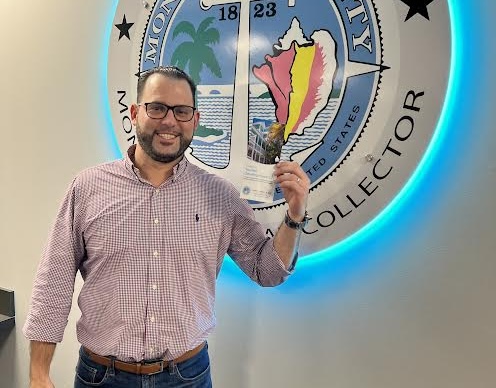

Monroe County Tax Collector Sam Steele is used to being lied to; it comes with the territory.

“It’s hard to believe everything that’s said to you, especially being a government official, because people say whatever they can to not pay something,” Steele said.

That’s why since taking office, Steele has stepped up public outreach efforts to clear up any ambiguity when it comes to local tax obligations for properties being rented for six months or less.

Besides giving presentations to community organizations about the required tourist development tax, or bed tax as it is sometimes called, Steele has also taken out newspaper advertisements, increased his office’s social media presence, and taken to the radio airwaves.

“We’re trying to inform and educate property owners as much as possible,” said Steele, who took the reins of the Monroe County Tax Collector’s office in 2021 at the age of 33, becoming the youngest tax collector to be elected in Monroe County’s history. Steele is currently the youngest tax collector in Florida.

Like other popular tourist destinations, Monroe County has seen an increase in properties being used as vacation rentals. But many property owners either don’t understand the local tax obligations, or simply choose to ignore them.

Last year, along with their property tax bills, Monroe County property owners received a color brochure titled “A Guide to Tourist Development Tax,” detailing rental requirements for property owners and managers.

“In the past our office used to send out this one-page orange flier that didn’t have quite as much information on there,” Steele said.

The new brochure explains, in detail, state and local tax obligations for short-term rental properties; 7.5% sales tax must be remitted to the Florida Department of Revenue, another 5% in tourist development tax (TDT) must be remitted to the Monroe County tax collector.

“We’re very lenient with other things,” Steele said. “Tourist development tax is one thing we’re very firm on. We have a very strict policy.”

In fiscal year 2022, a whopping $90 million in TDT was collected in Monroe County. Fiscal year 2023 saw a decline of $9 million, with $81 million being collected.

“I think there’s going to be a downward trend. I don’t know how fast it’s going to go,” predicted Steele.

Besides widely distributing the brochures, Steele also uses a software program called RentalScape to identify rental properties not in compliance with TDT requirements. The software cross-references and mines information from roughly 80 different online platforms, including VRBO and Airbnb, Steele says it works.

“When these property owners try to say ‘I just started renting a week ago’ and we find out that they’ve been renting for over a year, I have no leniency for them,” said Steele.

When noncompliant rentals are identified, Monroe County certified fraud examiner Pamela Sellers rolls up her sleeves.

“Once you’re on my radar, there’s no getting around paying back taxes,” said Sellers, adding the tax collector’s office can go back 36 months to recover unpaid taxes.

“The burden of proof is always on the taxpayer,” she said.

Between April and October 2023, countywide, Steele’s office, with the help of RentalScape, collected $432,076 in back taxes, penalties and interest.

A large portion of the money recovered came from Marathon. Steele said that was the result of collaboration between the city and the his office.

“Pamela and I met with the City of Marathon and requested them to add a requirement on their vacation rental application for property owners to provide their TDT account number,” Steele said. The requirement resulted in 147 fraudulent properties being identified and brought into compliance and $335,159 in back taxes, penalties and interest collected.

“We do have teeth when it comes to enforcement on fraudulent vacation rentals,” Steele continued. “We’ve had a couple of people who have actually done jail time over it,” he added.

“We can take them to circuit court and order their books, which we have done,” added Sellers.

The tax collector’s office has the authority to place liens on non-compliant properties and to freeze bank accounts.

Many believe the proliferation of short-term rentals has contributed to the affordable housing crisis across Monroe County. In the near future, those paying their fair share in TDT may soon be part of the solution.

“I know the county is approaching legislation in session this year to get the ability to use tourist development tax for affordable housing,” said Steele.

Suspected fraudulent rentals can be reported anonymously to Steele’s office by calling 855-422-4540 or via email to rentalfraud@monroetaxcollector.com. Steele notes that emails are considered public record and may be subject to public disclosure.