Monroe County remains entrenched in a battle to remove itself from FEMA’s “naughty list” and improve its standing with the agency. The next item in that effort is a property list nearly 2,000 items long, according to a letter received from FEMA earlier this month.

A letter received on Aug. 7 detailed FEMA’s findings following a National Flood Insurance Program (NFIP) Community Assistance Visit (CAV) to determine the effectiveness of Monroe County’s floodplain management program, public information officer Kristen Livengood said in a press release.

A requirement for participation in the NFIP, the visit identified no problems with the county’s floodplain ordinance or recent violations of floodplain regulations, the release said. However, it continued, more than 1,900 structures throughout unincorporated Monroe County that are a foot or more below base flood elevation are currently listed on the National Violation Tracker (NVT) as structures with potential compliance issues.

Concerns about the NVT list were brought to the forefront when Monroe County officials approached FEMA about the feasibility of altering certain components of its floodplain ordinance – among other items, eliminating a restriction that caps downstairs enclosures at a maximum of 299 square feet, rather than the entire footprint of the stilted home.

The county has been under FEMA’s microscope since 2002, when it entered into a remedial plan after – in the words of a notice to Monroe County policyholders from Feb. 27 of that year – “deficiencies in the administration and enforcement of the County’s floodplain management ordinance that have resulted in a large number of noncompliant enclosures being constructed under elevated buildings in special flood hazard areas.”

Items such as the 299-square-foot restriction and an enclosure inspection procedure, the latter of which has drawn the ire of real estate professionals in recent months, were part of the 2002 remedial plan and a subsequent addition in 2003, respectively. As Marathon and Islamorada incorporated in the midst of the county’s back-and-forth with FEMA, establishing new municipalities without a documented history of violations in the process, both were left out of the remedial plan.

A meeting earlier this summer between FEMA and Monroe County officials to discuss problematic items found a tepid response on FEMA’s end, County Attorney Bob Shillinger told the county commission at its July 19 meeting.

“(FEMA) basically said, ‘What proposals do you have to offer as part of a revised remedial plan that would give us comfort that the county would backslide into the position that we were in decades ago,’” he said, “when, quite frankly, we were paying lip service to these regulations. We found ourselves in hot water.”

“Per FEMA’s request, on Aug. 17, Monroe County submitted a plan … to research structures on the NVT list,” Livengood’s release said. According to County Building Official and Floodplain Administrator Rick Griffin, the 1,900-property NVT list “can likely be substantially reduced” by submitting documentation and information to show compliant structures – whether they’ve been floodproofed, found in compliance with previous inspections, issued a Letter of Map Change, demolished, or located outside the county’s jurisdiction.

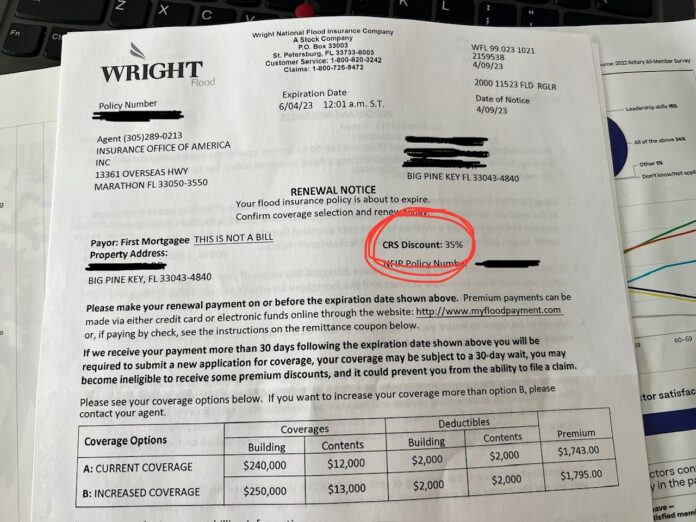

The county expects to submit a more detailed action plan to FEMA to address the noncompliant structures by the end of September, Livengood’s release said. But in the meantime, owners of properties on the NVT list may not benefit from the county’s flood insurance discounts through its participation in the Community Rating System (CRS), a program created to encourage responsible floodplain management practices through insurance discounts.

On a scale of 1-10, with lower numbers favorable, Monroe County is currently a Class 3 within the CRS, corresponding to a 35% discount on insurance premiums. But where property owners may expect to see this discount on their bills, owners of properties on the NVT list may see a zero instead, Livengood’s release said.

“If you see a zero, contact your insurance agent for more details on why a lesser discount is shown,” it continued. “The county is still developing the next steps, including seeing which properties can be removed from the list that are not in violation. Details for properties that may be in violation will be decided in the future.”