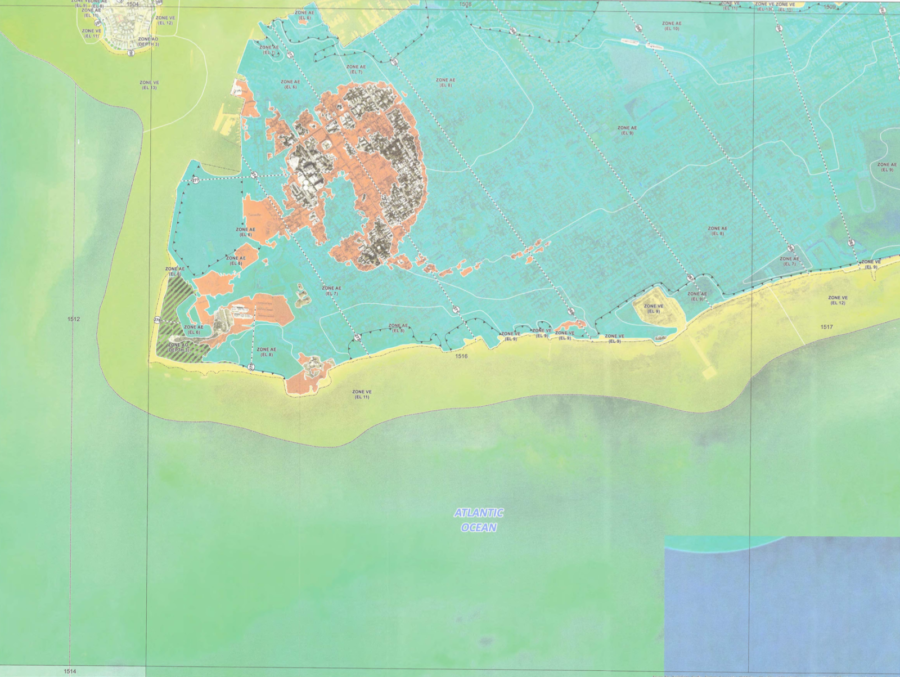

The much-anticipated day has finally arrived: the Federal Emergency Management Agency (FEMA) has released its draft floodplain maps, which will affect how insurance rates are calculated in the Keys. Municipalities have posted online draft maps where citizens can search by address. Key West’s is found on the city website, by going to the Building Department, then “New Flood Maps” and “Draft Flood Maps.”

Now that the draft maps are published, Monroe County and Keys municipalities will have an opportunity during a comment period to respond to the maps and, if they find adequate reason to do so, appeal them. Mayor Teri Johnston, who attended the Aug. 21 presentation of the draft floodmaps assures citizens:

“We have a number of city and county employees, along with FIRM and the expert consultants contracted to assist staff, as we analyze the anticipated impacts of the draft flood maps for our residents and business community. We are committed to minimizing the effects of the map changes and to identify new mitigation strategies for Key West after the maps go into effect.” Johnston is part of a chorus of voices, including Commissioner Heather Carruthers and FIRM president Mel Montagne, urging: “If you do not currently have flood insurance, please be proactive and purchase it.” Rates are projected to increase after the comment period.

After the comment and appeals period, government sources estimate the finalized Flood Insurance Rate Maps (FIRMs — confusing, we know) will go into effect in the summer of 2020.

The most drastic change in Key West is the shrinking of the “X Zone,” the area of Old Town with the highest elevation where homeowners are not required to hold flood insurance. The X Zone is projected to be approximately one third of its current size, which means two thirds of those properties, if not fully paid off, will be required to pick up flood insurance.

Beyond individual property owners, the real estate industry is in the forefront of those most affected by changes. Will Langley, president of the Key West Association of Realtors, said that while homeowners are at the center of the conversation, commercial property owners are getting hit even harder.

“Flood insurance commercially is going up astronomically,” said Langley. “I have a commercial property on North Roosevelt, and in 2017 the flood insurance was $6,900 a year, in 2018 $8,500, and in 2019 $10,600. This makes it more expensive to do business down here if you aren’t elevated. So at some point, instead of spending $10,600 a year on flood insurance, why don’t we think about hardening the structure, raising the structure?”

Langley is anticipating the changes to come for the Keys real estate market. He invited Val Marmillion, managing director of America’s Wetland Foundation, to deliver a presentation on sea level rise to the association of Realtors. Marmillion presented those same findings to the BOCC at its Aug. 21 meeting.

While the new FEMA floodplain maps are the current cause for concern, Marmillion urges residents and city officials to look farther into the future to plan for the steady, and inevitable, rise of sea levels.

“There is a new normal we are facing with sea level rise,” said Marmillion. “This is beyond a real estate issue … but there is some good news with the bad news: I think we have a great opportunity to lead into 2100.”

He said that Monroe County is ahead of most coastal communities in America in our planning for adaptation. He cited natural defenses of the Keys: sand, seaweed and plants like mangroves. America’s Wetland Foundation also offers maps that look to the future: while their projection of 2040 puts some parts of Midtown and New Town underwater in Key West, in 2100, they project the majority of the island will be underwater.

Marmillion said that in order to address this huge issue facing our community usefully, we have to de-stigmatize talking about it. The narrative of a plummeting real estate market and devalued 30-year mortgages make us wary to even discuss it. Yet, it’s of chief importance in property owners’ minds.

“According to their surveys, only about 50% of Americans express concerns about climate change,” said Marmillion, “but 100% express concern about maintaining their property value.”

According to the report, the concern is warranted. Included are numbers from a joint Zillow/Climate Center/NOAA study predicting a six foot sea level rise by 2100, which will result in the loss of 2 million homes and $900 billion of real estate. That said, the presentation also offers models to demonstrate how home owners will mitigate property value loss as well as overarching plans to harden and innovate coastal communities to encroaching waters.

Becoming a “sea safe community” means adopting a plan that includes designs for water storage with permeable surfaces and stormwater collection and removal; integrating water in parks and mixed use developments; grow green infrastructure assets like our natural canopies, native grasses and dunes; lead in adaptive development with floating homes and raised housing; enhance insurability via storm windows, building foundations and elevation.

“We tend to think in short-term horizons, but we need to think in long-term horizons, and this has given us the blueprint to do that,” said Commissioner Heather Carruthers.

“The reality for the Keys is that, just like we’ve hardened our infrastructure for wind, we’ll have to harden our infrastructure for water, from raising roads to one-way flow valves, to elevating homes and commercial property,” said Langley, who is also on The Key West Bight Board. “There are things that the city and county are doing and need to continue to.”

Langley mentions “success stories” of concrete slab homes being elevated. While it’s not a cost-effective option now, Langley said that government grants and loans are places the community might look for financial aid in shoring up our structures against rising water. He also posits that a national natural disaster insurance program protecting not just coastlines but also areas vulnerable to fires and tornadoes, etc. should be part of the national political dialogue.

In the meantime, should homeowners and future homebuyers in the Keys panic? Langley says no.

“The X Zone of Old Town is dramatically shrinking. But do I think banks are going to start offering shorter term loans? No, but I do think the demand of X Zone homes will remain constant.” The larger concerns, in his eyes, are properties and roads that are not elevated in New Town and the Lower and Middle Keys.

“As the Florida Keys,” he said, “we are all in this boat together, from insurance companies to renters to homeowners to bankers to real estate. I think we have the opportunity to be the leader in the world of this.”