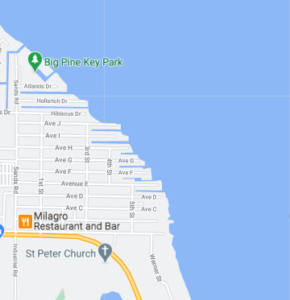

Two pilot programs will address coastal flooding and sea level rise in the Key Largo Twin Lakes subdivision and the Big Pine Key Sands subdivision. On Nov. 18, the Monroe County Commission told staff to begin preparing the groundwork for an extra “assessment” for homeowners in those neighborhoods.

The county hired Government Services Group (GSG) Inc. to calculate a rough estimate for flood mitigation, road elevation and utility adjustment costs: a $7.4 million cost shared among the owners of about 100 homes in the Key Largo neighborhood and $8 million for the 200 homes on Big Pine Key. That could mean up to $5,000 per year, for 30 years, in the Upper Keys neighborhood or up to $2,600 in the Lower Keys neighborhood under the same terms. The assessments could fall as low as $1,200 or $700 a year, respectively, if the county is able to find funds to offset 75% of the total costs.

The assessment method for funding is similar to how the county raised funds to sewer the Keys and how it has handled canal restoration projects. In canal restoration, for example, only homeowners owning property on a particular canal would share the cost of its cleanup and maintenance by agreeing to pay a special fee.

For the report, the assessments were based on the number of homes in the area, rather than the homes’ value. Vacant lots or undevelopable lots were not included, nor financing costs.

Could all the Keys be assessed?

Coming on the heels of how to finance sea level rise costs for the entire county, estimated at $1.8 billion, the conversation branched out to cover whether or not the entire county can be assessed to cover the cost of protecting the Keys.

Camille Pawlik, the senior advisor for GSG Inc., told the commission that blurring the line between property taxes and special assessments can end up in the courtroom. Property taxes can be levied to finance only general government expenses. Special assessments, however, must have a connection between the homes assessed and the special benefit of the assessment; in this case, the main factor would be elevating the road.

“You can’t make everyone pay if they are not receiving a benefit from the project. In this case, the benefit would be access to your home,” she said.

County Administrator Roman Gastesi said assessing the entire county would be an overreach. “If we did a countywide assessment, say $50 a month, the neighborhood of Venetian Shores would not benefit because they already have an elevation of 5 feet.”

Pilot projects move forward

The best way to collect an assessment and collect funding for the project is by adding it to a homeowners’ tax bill. The commission gave staff the direction to start the process on the two pilot projects so that if and when it is complete, the fund collection could begin late next year.

“We are making moves to preserve our options,” said Commissioner David Rice, “some of which we may not implement. The cost for the pilot projects could be lower if we get some other money, but sea level rise isn’t paying a bit of attention to where that money comes from.”

County Attorney Bob Shillinger told the council, “Today is the day we need to start, but it’s not the point of no return.”