Monroe County homeowners could see a hefty hit to their bank accounts if new flood insurance rates imposed by FEMA take effect Oct. 1. That’s according to Fair Insurance Rates in Monroe, a nonprofit watchdog group, which said on Thursday that flood insurance rate increases could range anywhere from $100 to $9,000 annually.

“Rate increases of this size will be devastating to the economies of coastal communities, like Monroe County, and the increases could force homeowners to drop coverage — an action that would then compel the lender to force-place flood coverage, or even worse, lose their homes,” Mel Montagne, FIRM president, said in a statement.

FEMA’s latest National Flood Insurance Premium (NFIP) Risk Rating 2.0 calculates premiums based on the value of policyholders’ homes and the flood risk of individual properties. Through the risk rating, FEMA said it will reduce disaster-related suffering and costs by leveraging best practices, technology and flood-risk modeling and mitigation efforts.

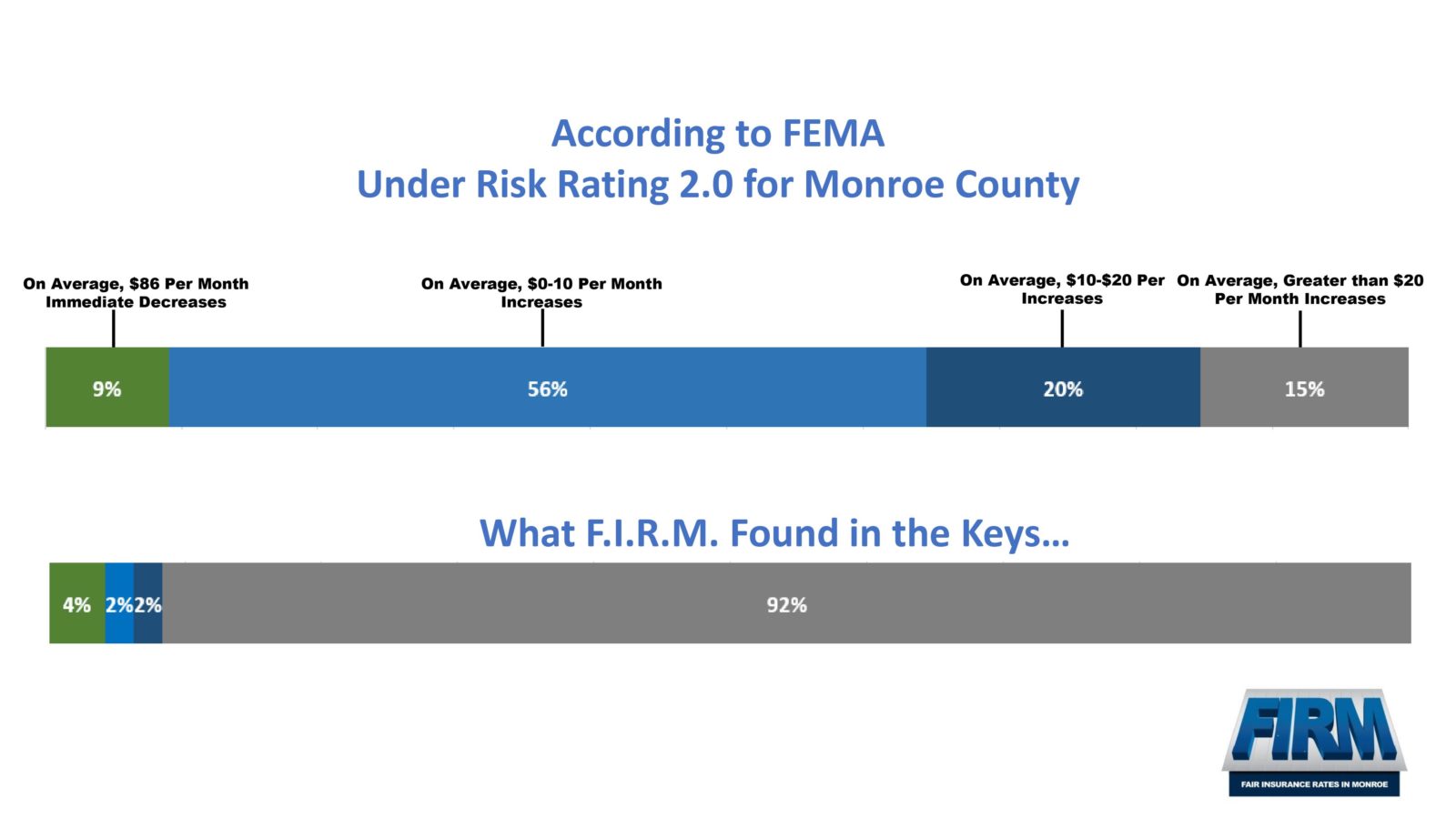

According to FEMA, 96% of current policyholders will see either an immediate decrease or $20 less per month in their premiums under the new pricing system. But FIRM said their database analysis shows something vastly different when looking at the Keys.

“Monroe County flood policy owners could expect increases averaging $3,200 annually,” FIRM states. “FIRM’s rate analysis is thousands of dollars higher than FEMA’s projected increases and contradicts them sharply. FEMA has said rates should increase about $240 annually for almost 93% of Monroe County policyholders.”

FIRM developed its database using privacy-coded Monroe County residences with and without elevation certificates. The database includes 48 single-family homes and condos, which are classified as commercial. The properties were run through the new FEMA Risk Rating 2.0 software to calculate the new and significantly higher premium rates.

Montagne said FEMA contends that Risk Rating 2.0 provides more accurate and transparent flood insurance pricing. However, the “untested proposal” is a huge, unregulated rate increase causing millions of flood policy holders to face extremely significant premium increases.

Over the last 50 years, FEMA said it has collected $60 billion in NFIP premiums, but has paid $96 billion in costs, including losses, operating expenses and interest. As a result, taxpayers and policyholders are adversely impacted when the program does not generate the revenue needed to pay claims.

Florida accounts for the largest number of NFIP policies in the country at just over 1.3 million. Texas is second with a little more than 661,800. In Monroe County, there are 30,799 active NFIP policies.

“A key part of developing nationwide preparedness is transforming the NFIP to ensure disaster survivors and communities can recover more quickly and more fully following flooding events,” FEMA said. “Under Risk Rating 2.0, rate increases will not continue indefinitely.”

FEMA acknowledges, however, that each policyholder will be affected differently under the new pricing plan based on their property’s individual flood risk.

“Some premiums will go up, some will go down, and some will stay about the same,” FEMA states.

Monroe County Legislative Affairs Director Lisa Tennyson said the county’s closely monitored FEMA’s development and planned implementation of Risk Rating 2.0 since its introduction several years ago.

“The impacts are heavily skewed against coastal communities, and we will continue to be a part of the nationwide discussion and its effects on Monroe County policyholders,”she said. “Protecting affordable flood insurance is the number one federal legislative priority for Monroe County and has been since the Biggert-Waters reform in 2012.”

Montagne said details surrounding FEMA’s Risk Rating 2.0 are “confusing” and “limited.” And he said they’ve offered very little transparency or explanation as to how the new flood insurance rate methodology will work. FEMA plans to implement Risk Rating 2.0 on Friday, Oct. 1, for new policyholders and on April 1, 2022, for all other flood policy renewals.

Per federal statutes, NFIP annual increases are capped at 18% for primary residential properties and 25% for second homes and commercial properties. The Risk Rating 2.0 increases cannot exceed the rate caps; however, Tennyson stresses that the current annual rate caps are already unaffordable for most Monroe County homeowners.

“Nationwide, the average policy is about $800, in the Florida Keys, people are paying $3,000, $4,000 and$5,000 for their policies. Annual rate increases of 18% are unsustainable,” she said. “Monroe County’s main focus will continue to be on lowering the rate caps to under 10%.”

Policyholders in unincorporated Monroe County will see a 35% discount that will continue to be applied after Risk Rating 2.0 goes into effect. That’s due to Monroe County’s participation in the Community Rating System.

U.S. Sen. Marco Rubio signed onto a letter with fellow Democratic and Republican senators urging FEMA Administrator Deanne Criswell to delay the new NFIP rating system. Within the letter, it states that FEMA’s estimating 900,000 policyholders, or nearly 20% of all policyholders, will drop out of the program over the next 10 years in large part due to unaffordable premiums under Risk Rating 2.0.

“In light of this information, we are extremely concerned about the administration’s decision to proceed forward with the implementation of this program without first determining an alternative that avoids the prospect that hundreds of thousands of families will be inclined to forfeit flood insurance on their homes.”

U.S. Rep. Carlos Gimenez also signed his name onto a letter to House Speaker Nancy Pelosi and Republic Minority Leader Kevin McCarthy that expressed concern over the burden of potential double-digit rate hikes on policyholders.

“There are serious implementation questions surrounding Risk Rating 2.0,” the letter reads. “Our constituents and those involved in implementing FEMA’s rate hikes need more time to get the answers they deserve. The additional burden of up to double-digit rate hikes by FEMA for our constituents, especially those in low- and moderate-income communities is too much for them to bear.”

John El-Koury, realtor with Coastal Realty, said he’s set to do a closing with first-time home buyers next week. If they in fact close next week before Oct. 1, flood insurance would be $600. The week after that? $3,800.

El-Koury said he found out about the rate increases just two days ago.

“For somebody who’s a first-time buyer, that’s a lot of money,” he said. “It’s crazy.”

FIRM said the new rating system won’t use flood maps and zones to determine a homeowner’s premium rate. Moreover, it will use a series of models that will fundamentally change a property’s individual flood risk assessment, and therefore, its insurance premium.

Under the new methodology, flood maps and Base Flood Elevations (BFE) will not be used to determine rates. There will no longer be Preferred Risk Policies — those for properties in the so-called “X Zone” — but existing PRP properties will be grandfathered in until they reach the full actuarial rate.

Data of first-floor elevation, replacement cost value, construction type, foundation type and more are determined by FEMA’s undisclosed “internal data sets,” rather than elevation certificates. And FIRM said FEMA has no guidelines for appealing the information that its tools have provided.

FIRM has joined other concerned organizations, including the Coalition for Sustainable Flood Insurance based in Louisiana, in encouraging FEMA to delay the implementation of Risk Rating 2.0 until both methodology and rate structure effects are more thoroughly reviewed.

Montagne encourages Monroe County home and business owners to contact their insurance agents to determine the rate increases for their specific properties. He also suggested that they have an elevation certificate and have flood insurance in place to help offset anticipated increases. Contacting members of Congress asking for their assistance in delaying implementation is also important, he said.