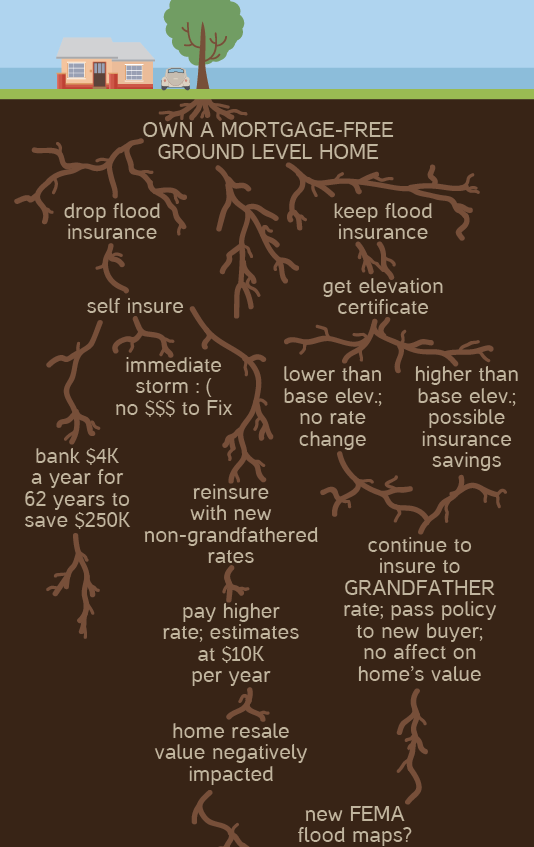

The house is almost paid off and it’s decision time. I’m wondering if I should get rid of flood insurance altogether and self-insure, or continue to pay flood insurance.

My husband and I bought our home in 1999, a ground-level concrete block home on Grassy Key. It’s a pre-FIRM home, meaning it was built before January 1, 1975 — that was before flood maps were a “thing” and before officials started urging Keys residents to build stilt homes, up and out of the flood zone.

My husband and I have never done any deep thinking about our flood insurance rates. The house did not flood during Hurricane Wilma in 2005 or Hurricane Irma in 2017. Mostly, we just moan about the bill that is required by our mortgage company to properly insure its risk.

So, I started with information gathering. There are two things to know about flood insurance — it is the only type of home insurance that is transferrable to a new owner; and it currently has a maximum payment of $250,000.

And there are two components to flood insurance rates. The Community Rating System (CRS) recognizes communities that manage their flood plain risk which, in turn, earns the entire community a flood insurance discount. Until 2017, the City of Marathon was unrated. From 2017 to 2019, every residence in Marathon has benefited from a 15% discount on its flood insurance. In 2020, Marathon property owners get a 20% discount. Monroe County recently earned a 30% discount. (Remember, this is by community and does not apply to the entire Florida Keys.)

The second part of my insurance rate is based on my home’s individual flood risk. Both my flood insurance bill (mine is offered by Wright and backed by the National Flood Insurance Program, or NFIP) and the declaration page of my policy state “AE.” There are currently three categories of flood levels in the Keys: VE, or right on the coast; AE means inland; or X which means a sufficiently elevated zone where flood insurance is not required, but still recommended. The categories are then followed by a number that indicates the base flood level. My neighborhood designation is AE11, or 11 feet above base flood.

That matches what I could find online. Visit msc.fema/gov and type in an address to find base flood elevations by neighborhood. So, that’s a general idea of how my house sits in relation to the terrain, but what is my elevation exactly?

Ah, well, that requires an elevation certificate. Because we own a pre-FIRM home, we weren’t required to have an elevation certificate when we took out the mortgage. I confirmed this by, A) looking through every document I owned; B) calling Monroe County to see if they had it on file; and C) calling the City of Marathon for the same reason. Nada. And, because there is no elevation certificate, I am charged the highest base rate for a pre-FIRM ground level home.

So, then I called J.P. Grimes, a surveying and mapping company based out of Key Colony Beach. John Grimes came out this past week and measured my elevation from inside the home, at the lowest part with machinery servicing the building; in my case, the refrigerator. He then compared that to a U.S. Coast and Geodetic Survey Marker, which is an official and certified elevation point.

My elevation certificate says my home sits lower than the base flood elevation. (Damn.) Fortunately, my agent at Regan Insurance, Holly Redding, said the flood insurance rate won’t go up based solely on this information. (That’s okay.) Unfortunately, I’m already paying the highest rate. (Damn.) Had my elevation been higher than 11 feet, I would have earned a rate break.

But, again, do I really need flood insurance? The maximum payout for any NFIP stand alone home policy is $250,000 and that is only if it’s a total loss. In theory, and barring any disaster of Mother Nature’s making, we could self-insure — bank the money every year until we have a cash fund accrued that would be enough to rebuild. It would take years, though, and a hurricane could come along before I’ve saved enough.

But the real humdinger is the coming changes to the National Flood Insurance Program as it relates to new FEMA flood maps (more on this next week). The drafts will be released this summer. It’s unlikely the new maps will be in my favor and I will with almost 100 percent certainty see my flood insurance rates rise above what they are now.

So far I’ve talked about my house as a domicile. But, like many other middle class residents of the Keys, it is my biggest investment; one day, it will fund my retirement. I could sell it and move to, say, The Villages. That’s totally not going to happen. But, seriously, I could need the money from the home’s sale to finance assisted living, or something like that as my husband and I age.

But if I drop the insurance, the person who buys my ground-level home with a bank mortgage will have to pay the non-grandfathered flood (capped) insurance rate, which some say will be as high as $10,000 a year for a home built below base flood elevation. Alternatively, I could find a cash buyer who is willing to self-insure. In both those scenarios, the buyers have the upper hand. My investment is worth less. My last option is to keep my insurance and continue to pay nearly $4,000 a year for a service/risk I have never required in the 20 years I’ve owned it.

I don’t think there is a good answer. And I don’t think I’m alone.

ABOUT THE COMING FEMA FLOOD MAPS:

For the past four and a half years, FEMA has been working on draft Flood Insurance Rate Maps. Although the agency reportedly has the work done, the draft results will not be made public until sometime this summer. Monroe County and Keys municipalities must accept FEMA’s finding in order to remain eligible for the National Flood Insurance Program and earn a community wide discount for. Of course, it’s impossible to have a mortgage without also insuring against flood.

It is likely the base flood map elevations are expected to be higher — one to two feet in some areas.

Monroe County estimates that a home built below base flood elevation could pay up to $9,500 a year in flood insurance. Yes, $9,500. This would mostly affect the older Conch homes built at ground level, the same ones that serve as de facto affordable housing. Right now, officials are asking owners of uninsured (flood) properties to get an elevation certificate and seek out flood insurance before the maps are finalized so they can capitalize on lower rates.

Next week: More information about the details of the new FEMA flood maps including LIDAR mapping, how the Keys will evaluate and or appeal the ma