There’s a little-known and less-understood proposal to increase Florida’s minimum wage from the current $8.46 to $15 by 2026. The initiative, known as the $15 Minimum Wage Initiative (Initiative #18-01), could appear on the November 2020 ballot as an initiated constitutional amendment.

If approved by voters, the initiative could substantially reshape if and how businesses in the Keys operate and succeed. So why shouldn’t a divemaster, bellhop, or bartender want an increased minimum wage? Daniel Samess, CEO of the Chamber of Commerce, cautions, “Most folks don’t understand what’s going on. The devil is in the details, and we’re being sold a Trojan horse.”

Samess is referring to the interplay of minimum wages and tips under Florida law. Currently, employers deduct a $3.02 “tip credit” from the state-mandated hourly minimum wage for tipped-employees. Servers are paid $5.44 per hour ($8.46 minimum wage minus $3.02 tip credit), and all tips (before taxes) are theirs to keep. It works out well for them because they usually earn more than $3.02/hour in tips, resulting in a much higher total income than minimum wage.

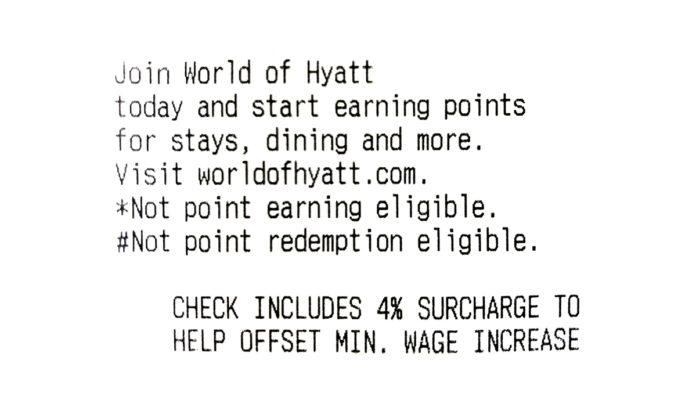

Under the proposed initiative, minimum wages increase but the tip credit remains constitutionally frozen at $3.02. This results in doubled labor cost to employers ($15 minus $3.02 = $11.98/hour). To offset higher costs, Samess hypothesizes business owners will raise prices, cut employees, lessen hours, and/or replace tips with a European-style service charge that businesses could keep.

Higher prices end up hurting businesses with low margins like restaurants and bars. “Business expenses go up; employees make less money; costs get passed on to the consumer,” says Samess. “Now a $10 hamburger will be $15. Who’s going to buy that?”

In a state and county so reliant on tourism, these price increases will be detrimental to the local economy. “We compete against other parts of Florida, other states, and the Bahamas for businesses and tourists,” explains Samess. “If we increase the prices of our burgers, our margaritas and our rooms, people won’t come to the Keys any more. We’ll price ourselves out. Then everybody really loses.”

Businesses trying to adapt to higher labor costs face difficult economics. Karen Thurman and Jason Bronis manage and operate Faro Blanco Resort & Yacht Club in Marathon. “Our tipped employees make $25 to $35 an hour on average when you factor in tips,” says Bronis. “We can’t match that as a wage no matter how much we raise our prices.” Thurman adds, “For us, the proposal would mean an additional $38,000/month total for my food and beverage payroll. That’s a lot.” She guesses these economics will drive many businesses to close.

While businesses will certainly suffer and tighten their belts, many predict the initiative will actually hurt tipped employees most. Sheldon Suga, vice president and managing director at Hawks Cay Resort in Duck Key, says, “Servers making an excess of $15 per hour right now with tips — they lose. They’ll be the hardest hit.” He continues, “And even if restaurant owners can afford to keep someone at $15 per hour, they’ll have to let go of five others. Those guys don’t get $15 per hour; they get nothing.”

Often, tipped employees value the flexibility and financial stability that service-industry jobs provide. “Right now, at an upscale restaurant, a server has the ability to work for four to six hours and walk out with a few hundred bucks after tips and wages,” says Thurman. “That’s good money, and they don’t have to work 40 hours a week. So if they’re going to school or a single mom or working a second job, they can.” Under the proposal, that same server working the same six hours at $15 per hour leaves with $90 in wages and no tips.

“We’re taking people from upper middle class and moving them to poverty wage,” said Thurman. Or, they’ll have to shift to full-time wage work to make the same money and change their entire lifestyle to make it by.

This could happen to “A,” a full-time server at an upscale Marathon restaurant. He estimates that tips make up 90% to 95% of his income. A only works nights. “I want to sit in my backyard and read a book; I value this. I’m enjoying the Keys,” he said. The shifted model could force A to take on more hours and daytime work to make up for lost gratuities. He says, “I just don’t think the proposal is a good idea. If it ain’t broke, why fix it? Know what I mean?”

“B,” another anonymous worker, is a part-time server at an Islamorada restaurant and a weekend dive instructor. Tips from both jobs support his full-time job at a local non-profit and make up 15% of his income. That tip money provides him a “financial buffer” to seriously consider buying a home or going back to graduate school. Losing it delays those goals, and makes them harder to achieve.

While the proposal seems to pit employers and employees against each other, it’s actually “lose-lose,” says Samess. Suga agrees: “Everybody deserves fair wages. There just has to be a better way to approach this.” Samess boils it down, “Employers won’t be favorable not because they don’t want employees to succeed but because it will put them out of business. How do we help employees if businesses go under?”

What it looks like other places:

Other cities and states that have enacted minimum wage laws. Some experts studying the laws have found negative effects.

• Colorado: Enacted. Potential impact: growing unemployment and no lessening of poverty levels. Source: Employment Policies Institute. Actual effects: raised prices, cut employees, potentially closing businesses. Source: KRDO.

• California: Enacted $15 minimum wage law in 2016. Potential effects: rural manufacturing job loss; increased taxes to pay for government contracts and public school teachers. Source: Forbes.

• Seattle: Enacted $15 minimum wage law in 2014. Results: increased wages for those working; increased barrier to entry to workforce; decrease in overall average pay. Source: NYT and Information Station.