When it comes to flood insurance, many of us want to just stick our heads in the sand. Turns out, it can be confusing, frustrating and expensive to insure a house on an island. Luckily, the county is taking steps to mitigate some of that cost and frustration.

The Community Rating System (CRS) recognizes communities that manage their floodplain risk which, in turn, earns the entire community a flood insurance discount off their premium. The percentage discount depends on what class determination the community is given.

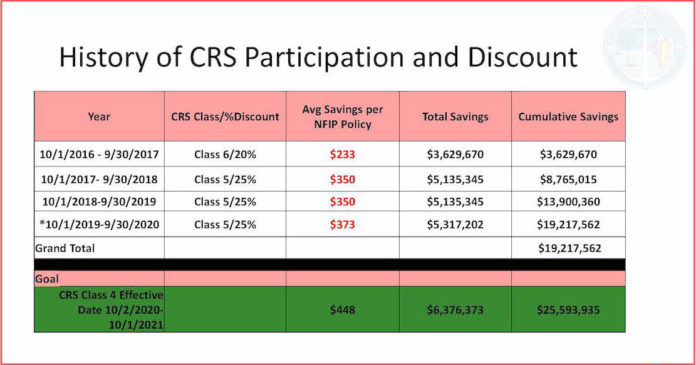

Since 2015, the county has moved from a Class 6 to a Class 5, with a 25 percent savings to insurance holders, by correcting more than 300 findings in the original audit by FEMA. Monroe County is classified in “Good Standing” with the agency that controls the National Flood Insurance Program (NFIP) and implementing programs that raise awareness of impending flood issues, as well as regulations that protect property and lives. Overall, the current designation has cumulatively saved flood insurance policyholders more than $19 million in the past five years.

At the January BOCC meeting, Monroe County’s Community Rating System (CRS) consultant Lori Lehr took it a step further, presenting a draft Repetitive Loss Area Analysis (RLAA) for unincorporated Monroe County to the BOCC. The RLAA plan looks at repetitive and severe repetitive loss properties, including the claims from the last five major storms. There are 391 structures on 370 parcels with seven listed as severe repetitive loss properties. Unincorporated Monroe has 60 repetitive loss areas that include 9,543 properties (with sites similarly situated in elevation and building type within these areas), which includes homes that do not have insurance or are raised above flood but still fall within the area.

Adoption of a final RLAA is the final step for the county to be eligible to move from CRS Class 5 to Class 4. If successful, the new designation will save flood insurance policyholders additional hundreds of dollars yearly. Total county savings annually would go from $5,317,202 to $6,376,373.

Lehr reviewed the Class 4 prerequisites: “A community must demonstrate that it has programs that minimize flood losses, minimize increases in future flooding, protect natural floodplain functions, and protect people from the dangers of flooding.” Recent sea level rise modeling of drainage infrastructure and drainage maintenance plan along with the recently implemented RLAA could move the county to the new designation.

“We would be the only Class 4 in a coastal community and we would be in the presence of only two other Class 4 designated counties in Florida,” said County Administrator Roman Gastesi. “This is a big deal.”

Assistant County Administrator Christine Hurey added a clarification for the benefit of homeowners. She said, “Just because your residence is in a repetitive loss area does not mean that your structure is at risk. It just means there are properties in that area that are at risk.”

Hurney said that if property owners have an elevation certificate or other information about their property, they could contact Lehr as the county adopts the RLAA. That information will then be put on file, so if the owner wants to sell the property in the future, the buyer can be guaranteed if the site is at risk or not based on the elevation certificate.

Hurley and Mayor Heather Carruthers emphasized this critical point. Hurley said, “So, it takes more than this report to create the full picture per property.”

Mayor pro tem Michelle Coldiron lauded staff for making sure the community gets the best rating possible for homeowners. Lehr agreed, saying, “The CRS program makes us aware and makes the public aware. We’re more resilient because of our participation in the program, and we’re making sure the public gets the benefit of the resiliency we’re promoting and the mitigation work we’re doing.”

Gastesi summed it up: “We’ve spent a running total of just under $500,000 in the last four years for this program, and you saw we’ll have saved $25 million.” He added, “That’s a nice return on investment.”

The presentation, plan, risk areas and additional information can be found at www.monroecounty-fl.gov/crs. The county is seeking public input on the draft plan and will be presenting the final plan for adoption at the Feb. 19, 2020 BOCC meeting.

With the completion of the latest CRS resilience tasks, the county will submit the documentation to go through the rigorous review process this summer, with a target goal to be rated a Class 4 by Oct. 1, 2020.

Monroe County has participated in the CRS program since 2016, when the community entered as a Class 6. Now, the county is applying to move to a Class 4 rating. Average annual savings on individual flood insurance would increase to $448 for a total savings of over $6.3 million. CONTRIBUTED