The FEMA floodplain maps have been looming on the horizon for South Florida and the Keys like a storm cloud. The preliminary maps drawn up by FEMA are projected to be unveiled in April (more likely over the summer). Scott Fraser, the city’s FEMA coordinator and floodplain administrator, and Steve Russ, vice president of the board of directors at FIRM (Fair Insurance Rates for Monroe County), spoke with us about what citizens should be aware of in the coming months. Fraser and Russ presented a comprehensive assessment of the floodplain map projections at the March 20 city commission meeting, slides from which are at the jump. Here’s what Key West residents should know:

These FEMA maps are the first model of their kind.

“This is the first time they are coming out with a completely new model, a high-end process, and South Florida is the first to try,” Fraser said. “They say this is the first time they can accurately predict the water inland. Almost every hurricane they have data on, they ran it through their model.” Note: the model did not include Hurricane Irma, which would likely have had a negative effect on insurance rates for Lower and Middle Keys residents but perhaps a positive one on rates in Key West. “FEMA has also announced they will change the way they are doing their insurance rates,” said Russ, “They have a new program coming out called Risk Rating 2.0.” It will be in effect by autumn 2020.

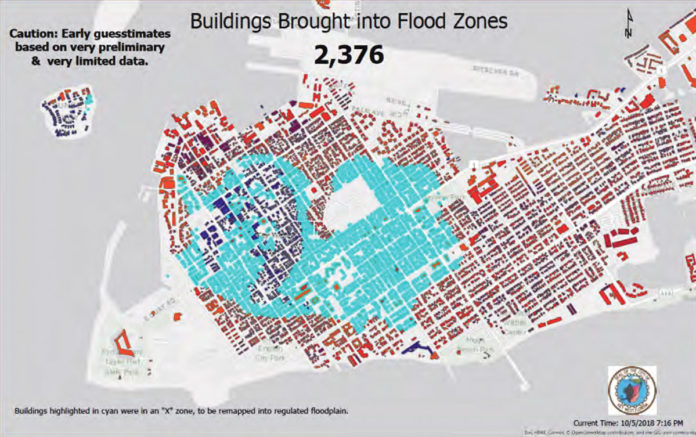

The X zone is shrinking.

The X zone in old town Key West encompasses the highest elevation in town. It has historically been considered a zone that is “safe” from flooding, and currently, there is no mandatory flood insurance for residents or business owners in the X zone. However, that is likely to change with these floodplain maps go into effect, the preliminary drafts of which show an x zone reduced by 2/3 in size.

How big a difference is there in these maps vs. previous flood maps

A big one. The new preliminary maps show considerable increases in water elevation during storms. For example, there is a projected nearly 10-foot difference in the previous floodplain maps and the new ones at the corner of Elizabeth Street and Truman Avenue. 86 percent of buildings in Key West will show flood level increase, and 2,378 buildings have been brought into flood zones.

What can we do?

Get flood insurance now. It will be significantly more expensive after the new maps are adopted. Also look into getting an elevation certificate, either from the city or a land surveyor. FEMA will offer a 90-day period for individuals and municipalities to appeal the accuracy of the maps. “Not by saying ‘my house has never flooded,’” said Fraser. “There’s only one thing that will have a successful appeal in any way, and that’s science or data.” That’s why the city is working with FIRM to look at variables like how the reef or using different data models may affect the flood elevation projections. “FIRM has already reached out to a professional hydrologist and engaged him to start looking at other models,” said Fraser.

“FEMA’s been working at this for five years, and we have 90 days,” said Russ, “so we’ve had to get a head start.” “For a community’s comments to be considered an appeal, they have to demonstrate that FEMA’s maps are scientifically or technically incorrect, then they have to provide correct information and address how to change FEMA’s maps.” Residents can also join FIRM. “The more people that join, the better we can communicate and the more people we can say we represent when we go to DC or Tallahassee,” said Russ.

Are old flood insurance rates grandfathered in after the new maps are adopted?

Kind of. “If you had a house that was 1 foot above base flood elevation, and new maps come along and now your house is 1 foot below—if you had a policy in effect, you will be grandfathered in at the old rate, and your insurance rates will hold,” said Russ. Homeowners with mortgages who newly find themselves in flood zones will be required to purchase flood insurance, as will businesses owned by federally backed agencies. “If somebody has a policy now and their flood zone changes, they will have incremental changes every year, but if you don’t have a policy, you’ll go right into the max,” said Fraser. Russ said that “under current rules, the person who buys your house also is grandfathered in,” but added “it depends on where you are … you should talk to an insurance agent.”

What does FEMA say about it?

Not much, yet. Fraser had to submit a Freedom of Information Act request to get preliminary projections, maps and data from the agency.

To learn more, visit FIRM at https://firmkeys.org/ . For more images from Fraser’s presentation, see p. 35

To learn more about how FEMA flood mapping affects the rest of the keys, read here.